Follow the Smart Money: Why, How, Who

"Follow the Smart Money" is never about the buzz words that stock market pundits and CNBC news anchors frequently uttered in their daily stock commentaries or news hype. It is about learning from the best and increasing your own winning chances.

What is the term "The Smart Money"?

Cambridge Dictionaries Online defined "The Smart Money" as

"money that is invested by experienced investors who know a lot about what they are doing."

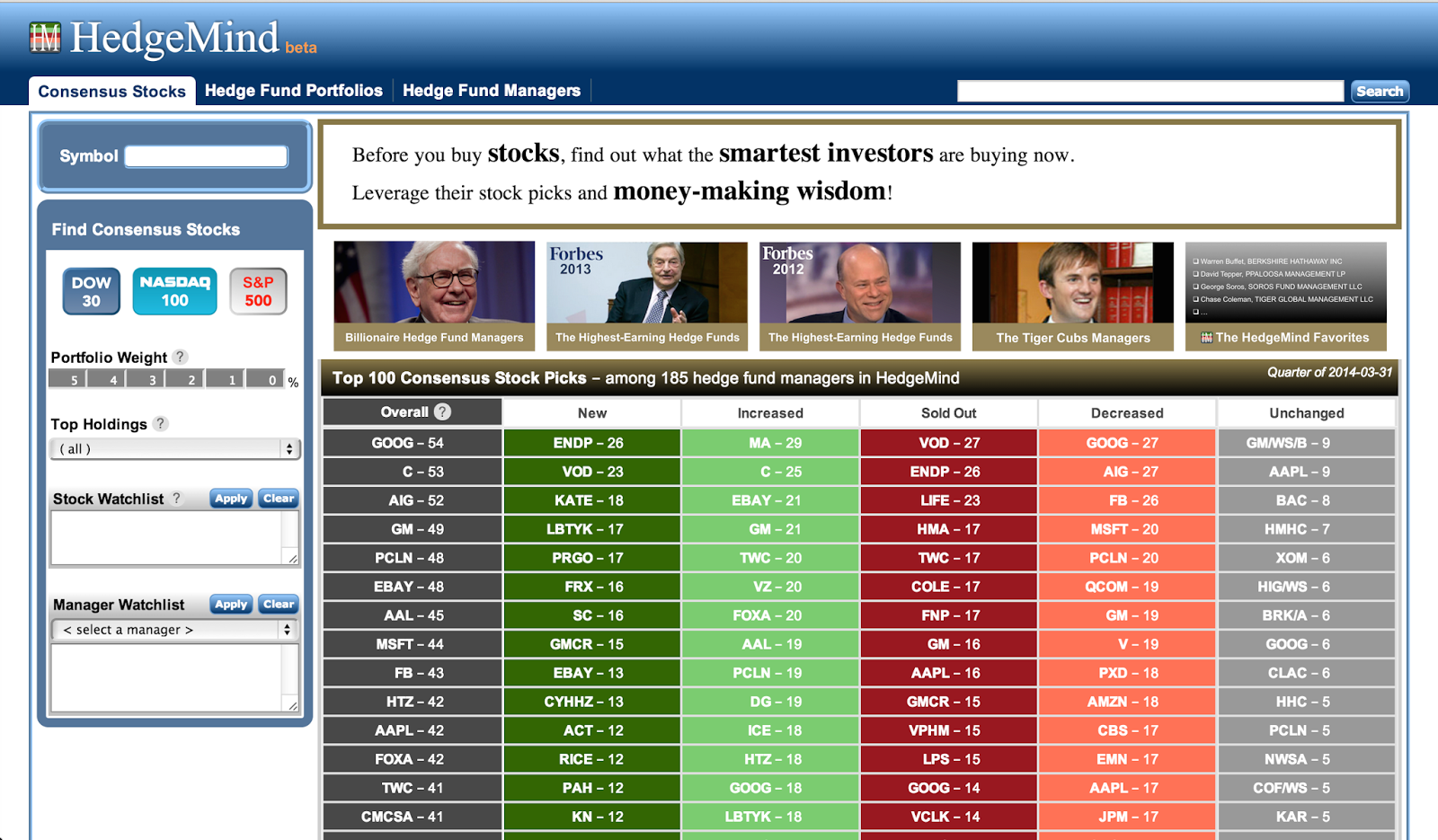

At HedgeMind, we defined "The Smart Money" as these ledgendary investors/traders: Warren Buffett, George Soros, Julian Robertson, Stanley Druckenmiller, Carl Icahn, David Tepper, Chase Coleman, Lei Zhang, Seth Klarman, Steve Cohen... who already became self-made billionaires through investing.

We also consider many young, rising star hedge fund managers as the smart money and worth active individual investors and traders to learn and follow. We will introduce them on this HedgeMind page.

We will use winning stock examples uncovered on the hedgemind.com to illustrate how the smart money produced winners and avoided losses. Hopefully we all will become a better and smarter investors.