Today I am going to show you one example how I use hedgemind.com to help me invest like the smartest investors.

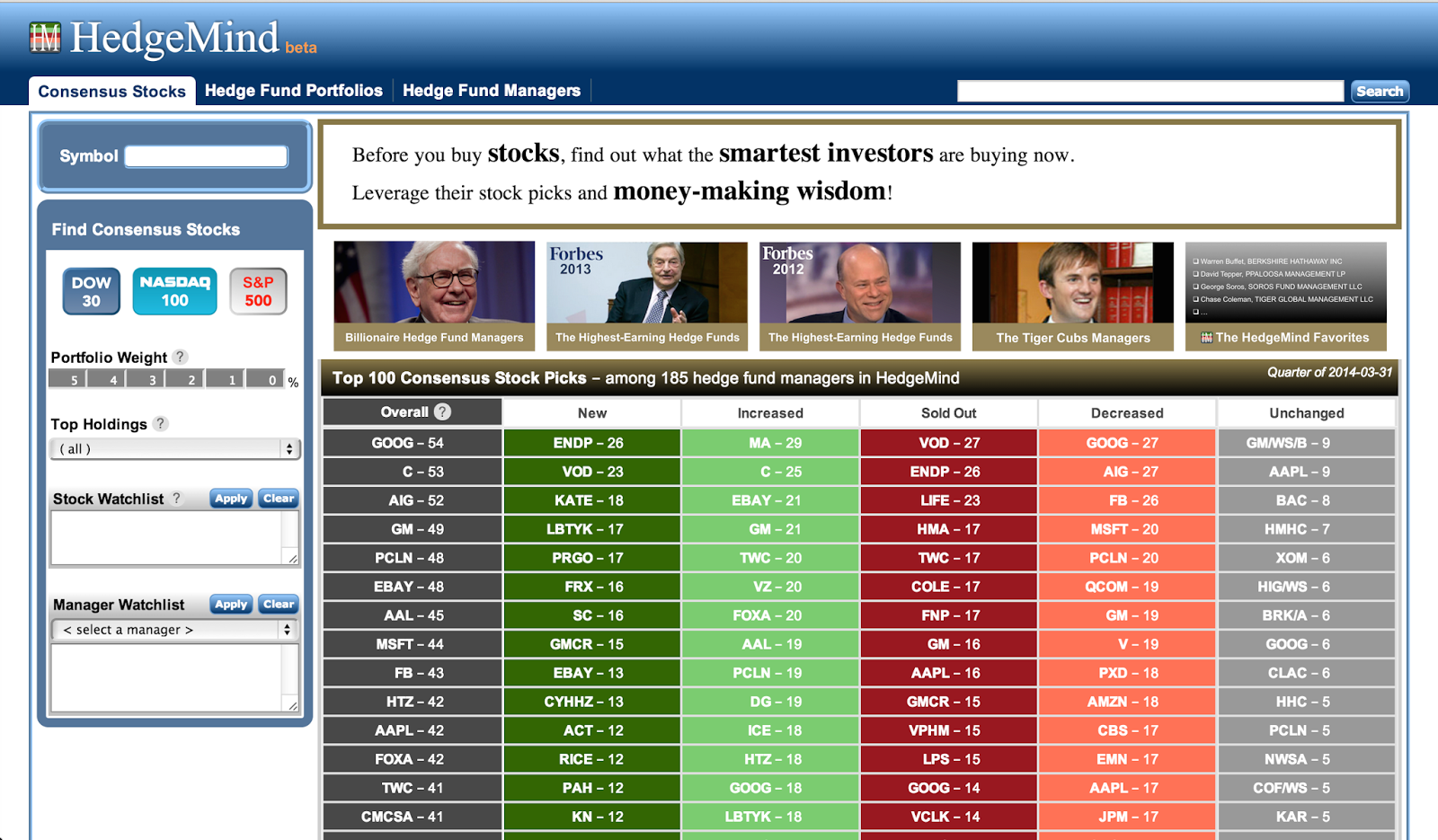

The Consensus Stocks page shows you the top 100 most popular stocks among top hedge fund manages we carefully selected. These 183 or so money managers include legendary investors like Warren Buffett, George Soros, Carl Icahn, as well as emerging top hedge fund managers like David Tepper, Chase Coleman, Daivd Einhorn, Stephen Mandel.

How do I use Consensus Stocks page to help my investing?

Every quarter when new 13F data is updated, hedgemind.com will publish immediately Consensus Stocks rankings based on the total number of hedge fund holders. The Consensus Stocks lists the top 100 most popular stocks among hedge funds.

The first thing I do is to review the top 10 most popular stocks among hedge fund managers since it reflects the collective wisdom of the smartest investors. I study each stock by browsing through its Stock Holders page and then Stock Holding History page of each hedge fund holder. Let me walk you through this process by using AAPL stock as an example:

This quarter, AAPL became the most loved stock among all 183 hedge funds and has 53 hedge fund holders, a 29% of hedge fund manages. To see who are these 53 hedge fund managers, clicking AAPL brings you to the AAPL Stock Holders page. The Stock Holder page shows the name of hedge fund manager who held AAPL and its portfolio weight in his portfolio. if a holding with portfolio weight of 5% or higher, it indicates strong conviction of hedge fund manager and typically this stock is a top ten holding of the portfolio as well.

As we can see, Carl Icahn is the largest holder of AAPL with 52.8 million shares (split adjusted), a total value of more than $5.3 billion as of today's price. Clicking Carl Icahn takes you to the Icahn's AAPL holding history page. Here you can see Icahn only used three quarters to accumulate a full position after acquired half of total position initially. It is clear that Icahn likes to initiate a significant stake first, then keep adding more in the next few quarters until it is fully accumulated.

Now let's take a look another AAPL Holding History of a well known Tiger Cubs fund manager, Philippe Laffont. You can see Laffont held AAPL stock for a while but he traded around actively from quarter to quarter. His active style of investing is in great contrast to that of David Einhorn who chose to buy and hold for a long time and only occasionally decreases or increases slightly.

Clearly a lot of insights can be learned from studying these pages. I personally benefited from this kind of analysis. In fact, 5 of my top holdings are among the top 10 most popular stocks, AAPL, FB, EBAY, GM, C. All of them produced great return for my own portfolio so far. So if you are an investor who actively manages your own money, hedgemind.com offers you the best resource to study and learn from the smartest investors. Even better, we made it FREE!

Sunday, August 24, 2014

Monday, May 19, 2014

Find What the Smartest Investors like Warren Buffett and David Tepper are Buying or Selling now

Today, HedgeMind just released Consensus Stocks screen tool. It helps investors quickly and easily find consensus stock picks among holdings of hedge funds based on key metrics like top holdings, portfolio weight, major stock indexes including S&P 500, NASDAQ 100, DOW 30.

With HedgeMind Stock Consensus screen, you'll be able to:

|

| Stock Consensus - help investors find top consensus stock picks |

With HedgeMind Stock Consensus screen, you'll be able to:

- Get quick glance at the most popular stocks among hedge fund managers in the most recent quarter.

- Have a stock on your mind? Simply enter the stock symbol to see who the fund managers have the same stock as a top holding in their portfolios.

- Just want to see top stocks within major market indexes like DOW 30 or NASDAQ 100 or ETF? You can use one-click Index button to find out immediately the most favored DOW stocks by hedge fund managers.

- Only interested in what Billionaire Investors or The Highest-Earning Hedge Fund Managers are buying? One-click view to show what they are holding now.

Labels:

Consensus Stocks,

Hedge Fund Managers

Location:

United States

Subscribe to:

Posts (Atom)